Inbound Logistics ran an article on network design at Schwan’s Home Services.

Schwan’s Home Services runs a direct to consumer delivery business for food products. Before network optimization, they served 90% of the continental US with 475 company owned depots. The depots each had around 10 to 15 trucks to make the deliveries. The depots were replenished from their central warehouse in Marshall, MN.

According to their VP of Supply Chain, Jeff Modica, their fixed costs were too high and their supply chain was outdated. They needed “a lower cost to serve” and “had to be more flexible.”

They used Deloitte Consulting to help with the modeling and to bring and outside perspective.

The article does a nice job in explaining the unique nature of Schwan’s Home Services’s labor and sales intensive business. It also does a nice job of pointing out the the fact that the network modeling team had to communicate and get the buy-in from many different stakeholders within the company. These projects are always a mix of quantitative analysis (and they used IBM’s LogicNet Plus) and qualitative factors.

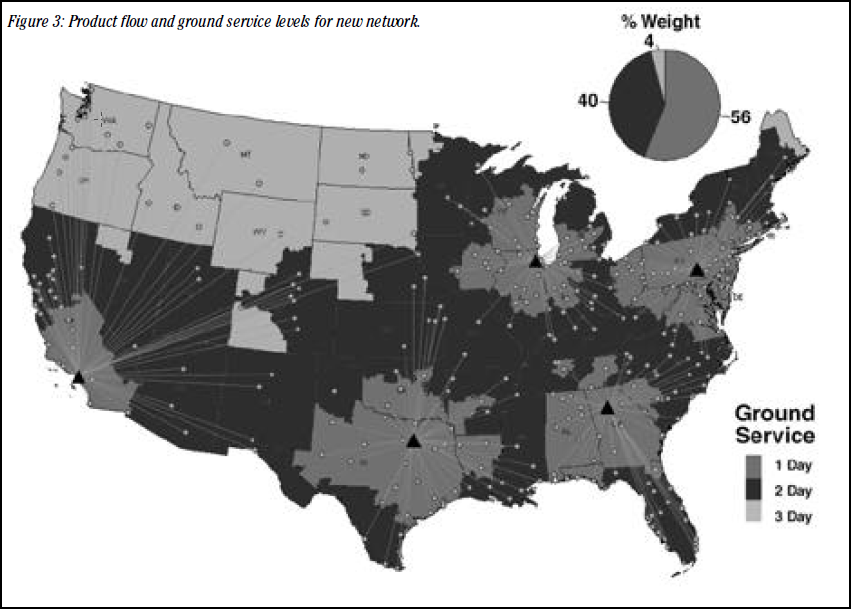

Deloitte initially recommended closing a dozen facilities to start– to get some quick wins (always a good idea in projects like this). Eventually, the closed 54 sites. And, they changed the structure of their supply chain:

Additionally, Schwan’s has migrated to a hybrid model that uses existing company-owned depots, master depots with hub-and-spoke shuttle systems, and 3PL-managed facilities. As the company removes and/or re-tasks nodes, the network continues to change—setting the stage for further optimization in 2013.

The article doesn’t tell us the savings, but it does mention:

While the financial impact of Schwan’s network optimization is under wraps, it achieved marked operational and asset appreciation savings, in addition to avoiding some cost and gaining revenue from the sale of assets.

The article is worth a read. This is a nice case study of a network design project.