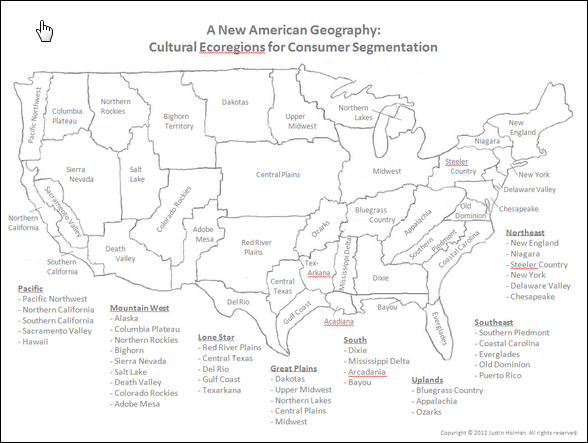

Justin Holman, the CEO of TerraSeer, recently wrote an interesting blog post suggesting that a great place to start a Big Data journey is to build a map. He argued that most firms and managers don’t have the resources or technical capability to do a full-blown analysis on all their data. But, a map is a relatively simple place to start that will allow you to visualize a lot of data quickly and in a new way (most firms still don’t use enough maps to view data.)

Justin Holman, the CEO of TerraSeer, recently wrote an interesting blog post suggesting that a great place to start a Big Data journey is to build a map. He argued that most firms and managers don’t have the resources or technical capability to do a full-blown analysis on all their data. But, a map is a relatively simple place to start that will allow you to visualize a lot of data quickly and in a new way (most firms still don’t use enough maps to view data.)

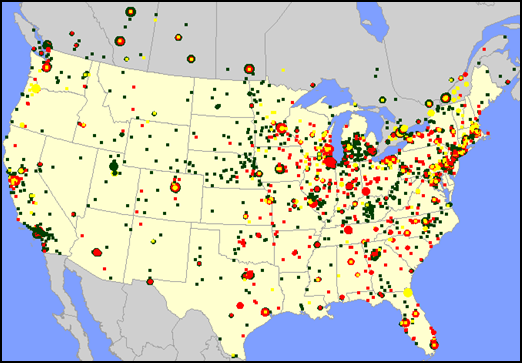

For the supply chain manager, I would agree. As we’ve discussed before, a map can be a great way to view your customers by different types and relative demand (as seen in the map above). It can also be a great way to see how product is flowing through the supply chain.

We have seen many cases where a company finds savings opportunities by just looking at their data on a map. It is often the first time the managers have seen the data presented in this way. And, it allows the managers to quickly understand their business in ways that were not obvious before.

Even if you are not doing a full-blown network design study, I would still recommend mapping your customers and supply chain. You may learn something new.

We typically think of network design at the national level. However, the same principles apply when doing a study at a very local level. For example, we’ve talked about the

We typically think of network design at the national level. However, the same principles apply when doing a study at a very local level. For example, we’ve talked about the